Employers that sponsor group health plans have some different options available to them for designing their plans’ enrollment process. When it comes to enrollment, health plan sponsors should have rules in place regarding:

- When employees can enroll in the health plan;

- When employees’ elections for group health plan coverage take effect; and

- What method is used for making elections.

There are some federal laws that impact how employers can design the enrollment process. For example, the Affordable Care Act (ACA) limits waiting periods for initial enrollment and requires applicable large employers (ALEs) to provide an annual opportunity for full-time employees to elect coverage. Also, the rules for Section 125 plans (or cafeteria plans) limit when employees can make changes to their pre-tax elections during a plan year.

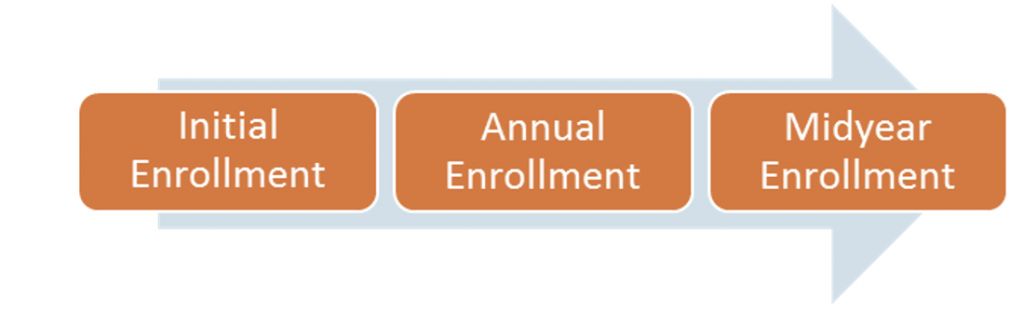

Enrollment Periods

Group health plans often provide eligible employees with two regular opportunities to elect health coverage—an initial enrollment period when an employee first becomes eligible for coverage and an annual open enrollment period before the start of each plan year. In addition, certain events qualify employees and their eligible dependents for enrollment opportunities during the plan year. These events—which are often major life events, such as marriage or the birth of a child—trigger midyear enrollment rights.

Although employers that sponsor group health plans generally have some different options available to them for designating enrollment periods, there are several legal rules that restrict how employers can design this process. Other restrictions on enrollment periods may be imposed by health insurance contracts or collective bargaining agreements.

Initial Enrollment Period

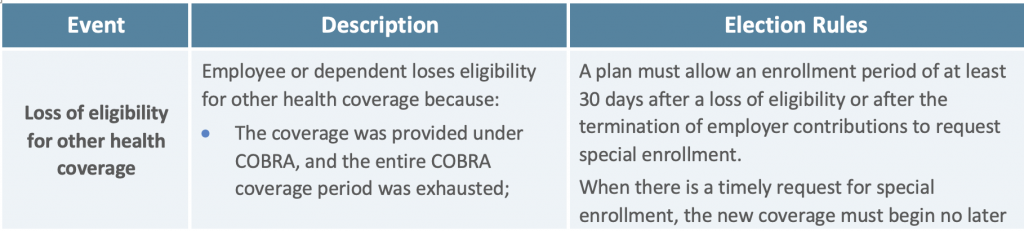

The initial enrollment period is the period of time when a newly eligible employee can enroll in an employer’s health plan. Employers should work with their health insurance carriers and advisors to determine what eligibility rules should apply to their health plan. The health plan’s eligibility rules should be communicated to employees through the plan’s summary plan description (SPD) and enrollment materials.

Federal law does not require a health plan’s initial enrollment period to be a specific length of time, although if an employer allows employees to pay their health insurance premiums on a pre-tax basis through a cafeteria plan, a 30-day open enrollment window for new hires is often used. This is because the Section 125 rules allow retroactive enrollments for elections that are made within 30 days of the date of hire.

If an employee does not enroll in coverage during his or her initial enrollment period, the employee usually must wait until the plan’s next annual open enrollment period to enroll, unless the employee experiences an event that would allow for a midyear enrollment. Also, as described below, the ACA’s reforms impact the timing of initial plan enrollment—both through the law’s prohibition on waiting periods that exceed 90 days and its employer shared responsibility rules for ALEs.

Prospective Elections—Limited Exception for New Hires

Many employers permit employees to pay for their share of benefit costs on a pre-tax basis through a Section 125 cafeteria plan. Under the Section 125 rules, elections for health plan coverage must generally be effective on a prospective, not retroactive, basis. This generally means that the employee’s election for benefits must be made before the first day of the coverage period for which benefits are to be provided. To help with plan administration, the IRS’ proposed cafeteria plan regulations include a special rule allowing retroactive coverage for new hires.

Under this special rule, elections that new employees make within 30 days after their hire date can be effective on a retroactive basis. Elections made during this enrollment window can be effective as of the employee’s date of hire, although the salary reductions to pay for the elected benefits must be taken from compensation that is not currently available when the election is made.

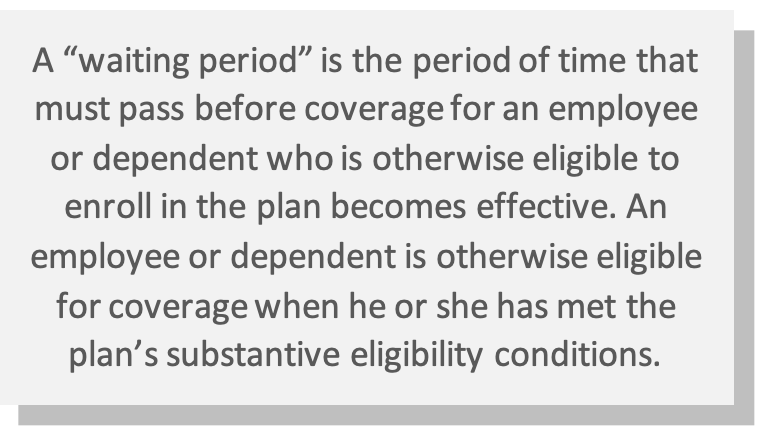

Waiting Periods

Employers will often impose waiting periods (or probationary periods) for new hires before health plan coverage becomes effective. Prior to the ACA, some health plans delayed the initial enrollment period for a significant period of time following an employee’s hire date, even requiring new hires to wait until the next annual open enrollment period to enroll in coverage. However, the ACA prohibits waiting periods for group health plan benefits that exceed 90 days.

Coverage Timing Rules for ALEs

ALEs (employers with at least 50 full-time and full-time equivalent employees) that do not offer affordable, minimum value health coverage to their full-time employees (and dependents) may be subject to penalties if any full-time employee receives a subsidy for health coverage through an Exchange. These employer mandate requirements are known as the employer shared responsibility rules. To avoid penalties, ALEs must offer coverage to newly eligible employees within certain time frames, depending on the method they are using to determine full-time employee status.

- For ALEs using the monthly measurement method, health plan coverage must be offered to full-time employees no later than the first day of the first calendar month immediately following the limited non-assessment period. The limited non-assessment period lasts three full calendar months, starting with the first full calendar month in which a full-time employee is otherwise eligible for coverage. This period provides ALEs with time to administer new hire enrollments without triggering a penalty.

- For ALEs using the look-back measurement method, health plan coverage must be offered to new variable-hour and seasonal employees who have full-time status no later than the first day of the stability period that is associated with the initial measurement period. For new employees who are expected to work full-time, health plan coverage must be offered no later than the first day of the first calendar month immediately following the limited non-assessment period (as described above under the monthly measurement method).

Annual Open Enrollment Period

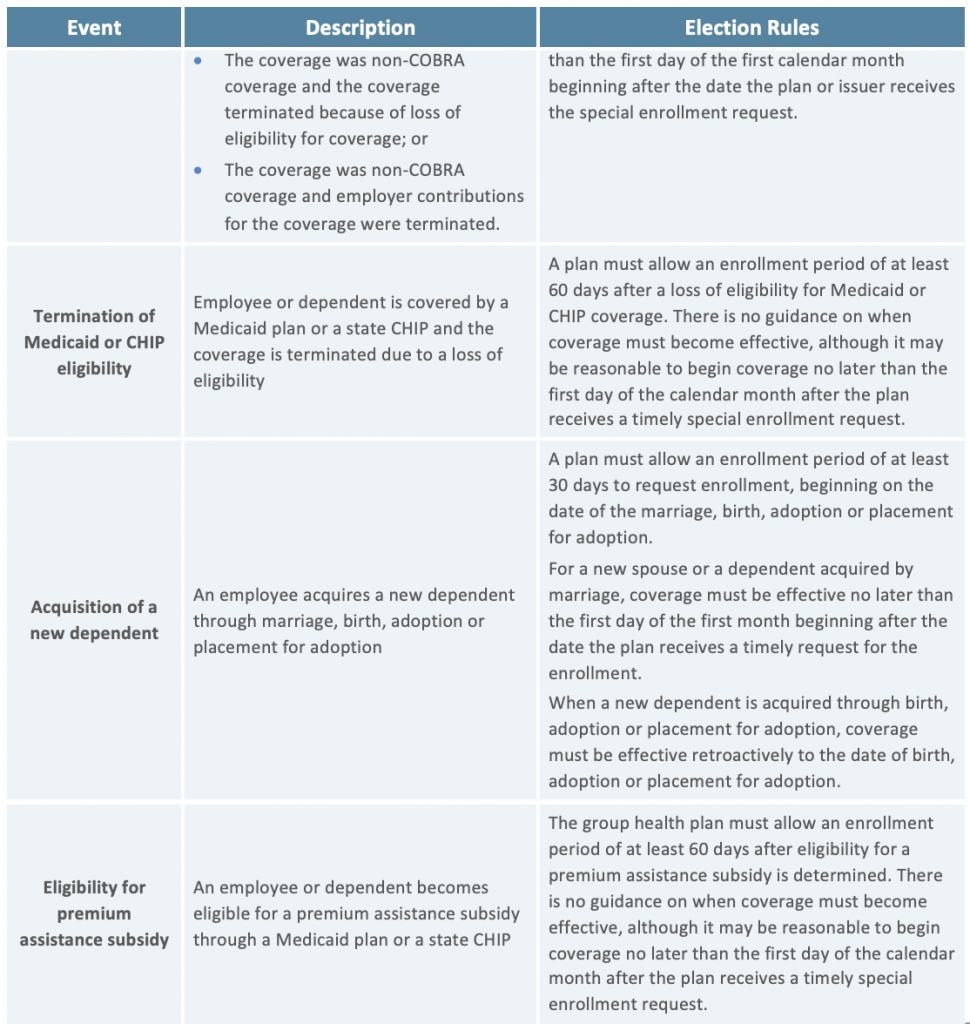

Most health plans allow employees to enroll in coverage (or change their coverage elections) during an annual open enrollment period. In general, open enrollment is the time period each year when an eligible employee may:

- Enroll in coverage, if the employee declined coverage when initially eligible or dropped coverage during a previous open enrollment period;

- Change coverage elections if the employer offers more than one group health benefit to choose from (for example, high deductible health plan (HDHP) and a non-HDHP); and

- Change enrollment for dependents (that is, add coverage for eligible dependents or remove eligible dependents from coverage).

Legal Requirements

Under the ACA, ALEs must provide an annual enrollment period to avoid triggering penalties under the employer shared responsibility rules. Final regulations issued by the IRS explain that ALEs are required to provide full-time employees with at least an annual opportunity to accept or decline coverage under the plan. ALEs that only provide employees with one chance to elect coverage (sometimes referred to as “one bite at the apple”) violate the ACA’s offer of coverage requirement.

Non-ALEs are not subject to the ACA’s annual offer of coverage requirement, but they may still be required to provide an annual open enrollment period under their contracts with health insurance carriers or the terms of collective bargaining agreements. Also, if an employer allows employees to make pre-tax contributions under a cafeteria plan, the Section 125 rules expect that participants will be given a period of time to make their elections each year.

In addition, if an employer’s health plan does NOT meet the ACA’s affordability or minimum value requirements, employees must have an effective opportunity to decline the coverage at least once per year. By declining this type of health plan coverage, employees can retain their eligibility for a premium subsidy under the ACA’s Exchanges.

Timing Rules

A health plan’s open enrollment period should take place prior to the beginning of the plan year for which employees are making their elections. Typically, open enrollment occurs sometime during the three-month period before the beginning of the plan year, and it may last one to two weeks or longer, depending on the plan sponsor’s preferences. As a general rule, elections under a Section 125 plan must be effective on a prospective, not retroactive, basis. Thus, the elections that participants make during open enrollment must generally take effect for the upcoming plan year.

For various administrative reasons, most open enrollment periods end well in advance of the upcoming plan year. For example, a calendar year plan’s open enrollment period may end in mid-November. This gives the plan sponsor time to take care of administrative tasks, including confirming elections, processing enrollments and performing preliminary nondiscrimination testing under Section 125.

Midyear Enrollment

Group health plan sponsors are required to allow employees to enroll in coverage during the plan year if they experience a special enrollment event under the Health Insurance Portability and Accountability Act (HIPAA). Employers may design their plans to allow for other enrollment opportunities during the plan year. However, employers with fully insured plans that want to allow other midyear enrollment periods should review their insurance policies and consult with their carriers. Also, under the Section 125 plan rules, employers can only allow employees to make changes to their elections for pre-tax benefits when certain events occur (called “midyear election change events”).

HIPAA Special Enrollment

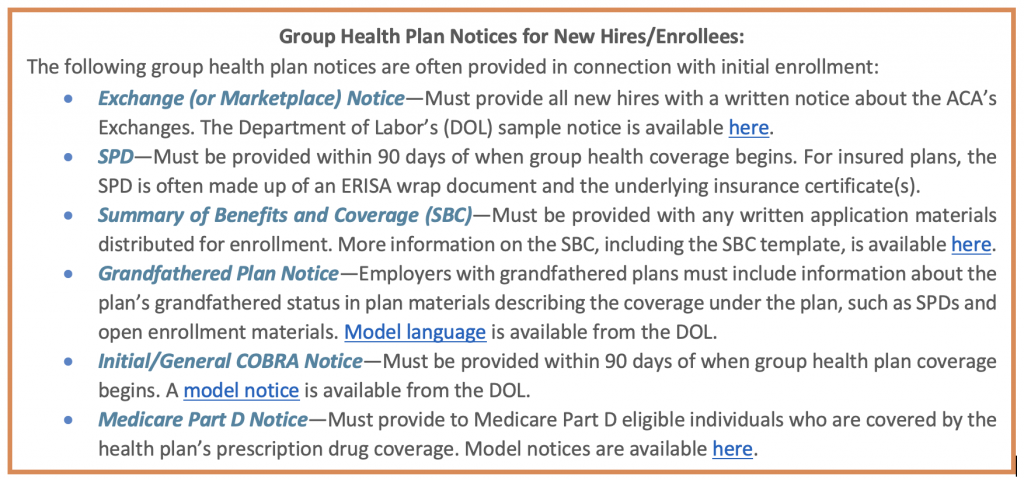

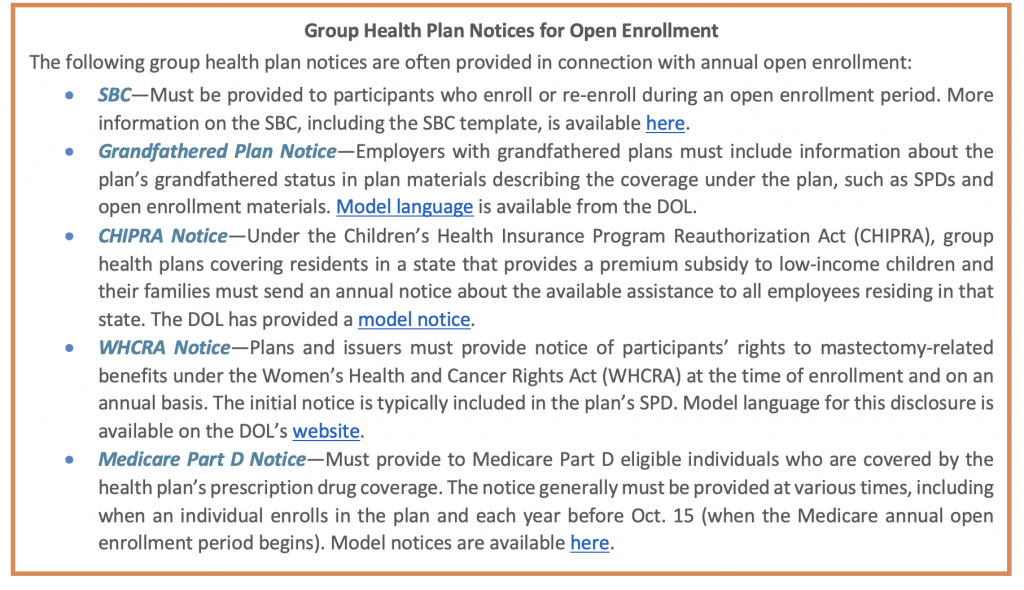

HIPAA requires group health plans to provide special enrollment opportunities outside of the plans’ regular enrollment periods in certain situations. The following table outlines HIPAA’s special enrollment events and the corresponding election rules.

Midyear Election Change Events

If an employer allows employees to pay for their health coverage on a pre-tax basis through a Section 125 cafeteria plan, the elections that employees make during open enrollment generally must be irrevocable for the upcoming plan year. This means that employees ordinarily cannot make changes to their Section 125 plan elections during a plan year.

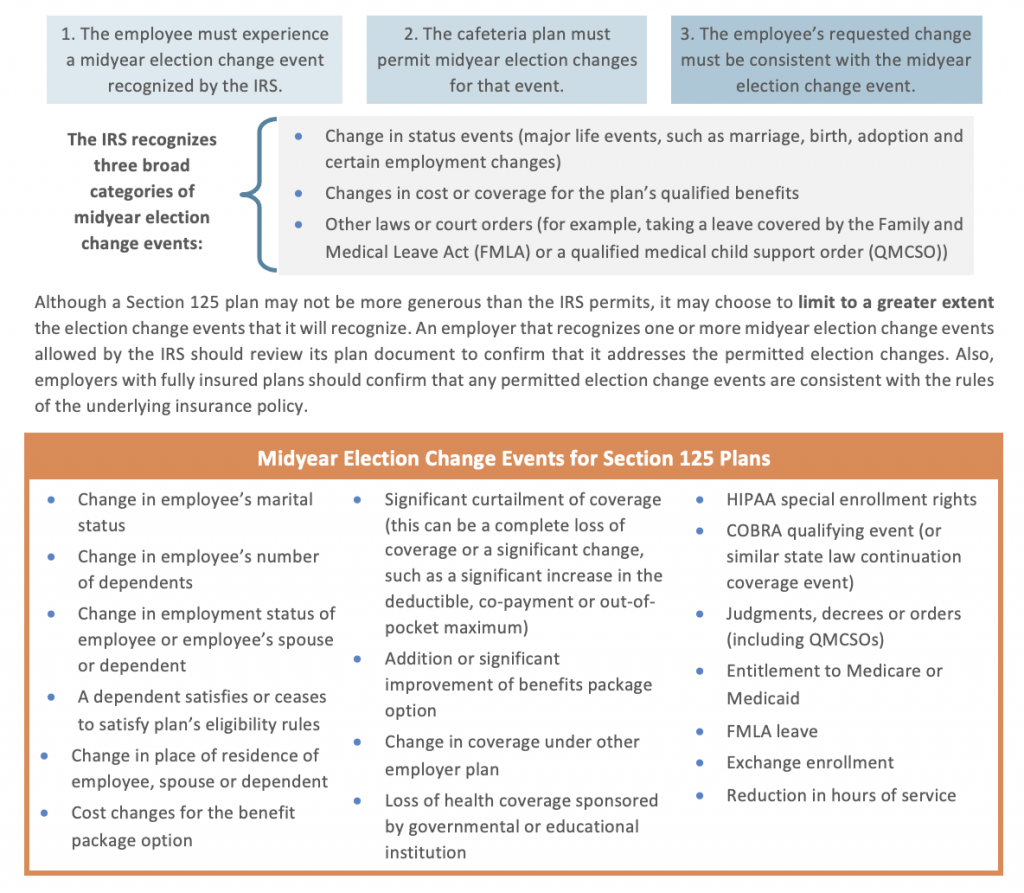

Employers do not have to permit any exceptions to the election irrevocability rule for Section 125 plans. However, IRS regulations permit employers to design their Section 125 plans to allow employees to change their elections during the plan year, if the following conditions are met.

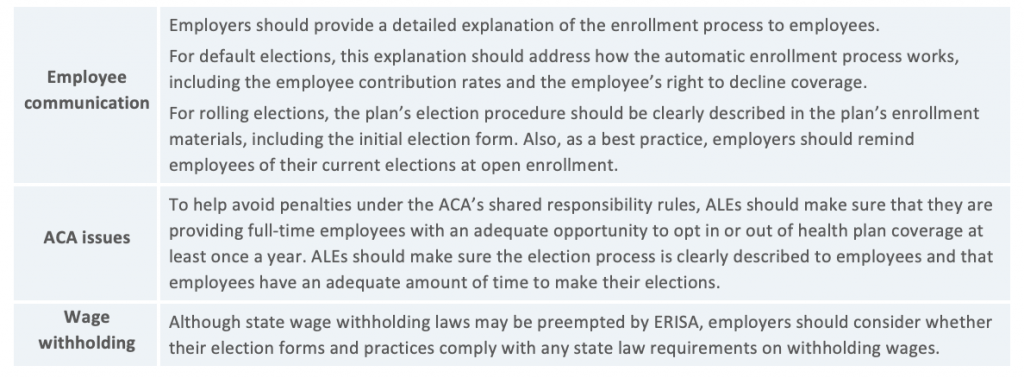

Election Methods—Affirmative, Default and Rolling

Health plan sponsors, even those with Section 125 plans, have some different options for how participants will make their elections during initial and open enrollment. The three main types of election methods are:

- Affirmative elections—Employees complete an agreement to participate in the plan.

- Default (or automatic) elections—Employees are automatically enrolled in the plan, unless they complete a waiver or otherwise opt-out of coverage.

- Rolling (or evergreen) elections—Current participants are deemed to continue their existing elections, unless they opt-out of coverage or elect a different level of benefits.

Although affirmative elections are the most common type of election method, the IRS has confirmed that employers may use default elections or rolling elections under a Section 125 plan. Employers that are considering using default or rolling elections for their group health plans should consider the following compliance tips: