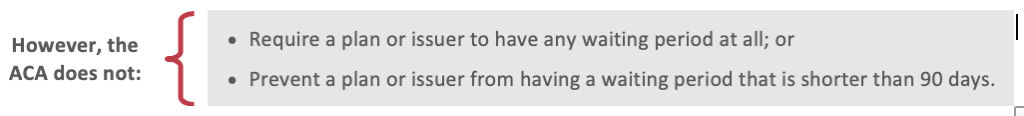

Beginning in 2014, the Affordable Care Act (ACA) prohibits group health plans and group health insurance issuers from applying any waiting period that exceeds 90 days.

This waiting period limit does not require an employer to offer coverage to any particular employee or class of employees, including part-time employees. It only prevents an otherwise eligible employee (or dependent) from having to wait more than 90 days before coverage under a group health plan becomes effective.

Although the 2013 proposed rules provided that the 90-day waiting period limit would apply for plan years beginning on or after Jan. 1, 2014, the final rules took effect for plan years beginning on or after Jan. 1, 2015. Thus, for plan years beginning in 2014, plans were permitted to follow either the 2013 proposed rules or the final rules.

Affected Plans

The ACA’s 90-day waiting period limit applies to both grandfathered and non-grandfathered group health plans and health insurance coverage. However, it does not apply to HIPAA-excepted benefits, such as limited-scope dental or vision plans and certain health flexible spending accounts (FSAs).

The 90-day waiting period limit applies to both the plan and the issuer offering coverage in connection with the plan. However, to the extent coverage under a group health plan is insured by a health insurance issuer, the issuer may rely on the eligibility information reported to it by an employer (or other plan sponsor). Thus, the issuer will not violate the 90-day waiting period limit requirements if it:

- Requires the plan sponsor to make a representation regarding the terms of any eligibility conditions or waiting periods imposed by the plan sponsor before an individual is eligible for coverage under the terms of the plan (and update this representation with any applicable changes); and

- Has no specific knowledge of the imposition of a waiting period that would exceed the permitted 90-day period.

Overview of the 90-day Waiting Period Limit

A “waiting period” is the period of time that must pass before coverage for an employee or dependent who is otherwise eligible to enroll in the plan becomes effective. An employee or dependent is otherwise eligible for coverage when he or she has met the plan’s substantive eligibility conditions.

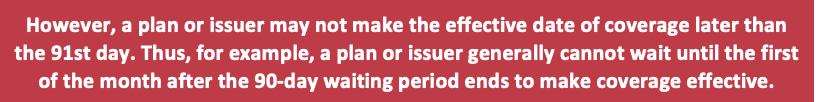

Under the ACA, a group health plan and a health insurance issuer offering group health insurance coverage may not apply a waiting period that exceeds 90 days. Thus, after an individual is determined to be otherwise eligible for coverage under the terms of the plan, any waiting period may not extend beyond 90 days. All calendar days are counted beginning on the enrollment date, including weekends and holidays.

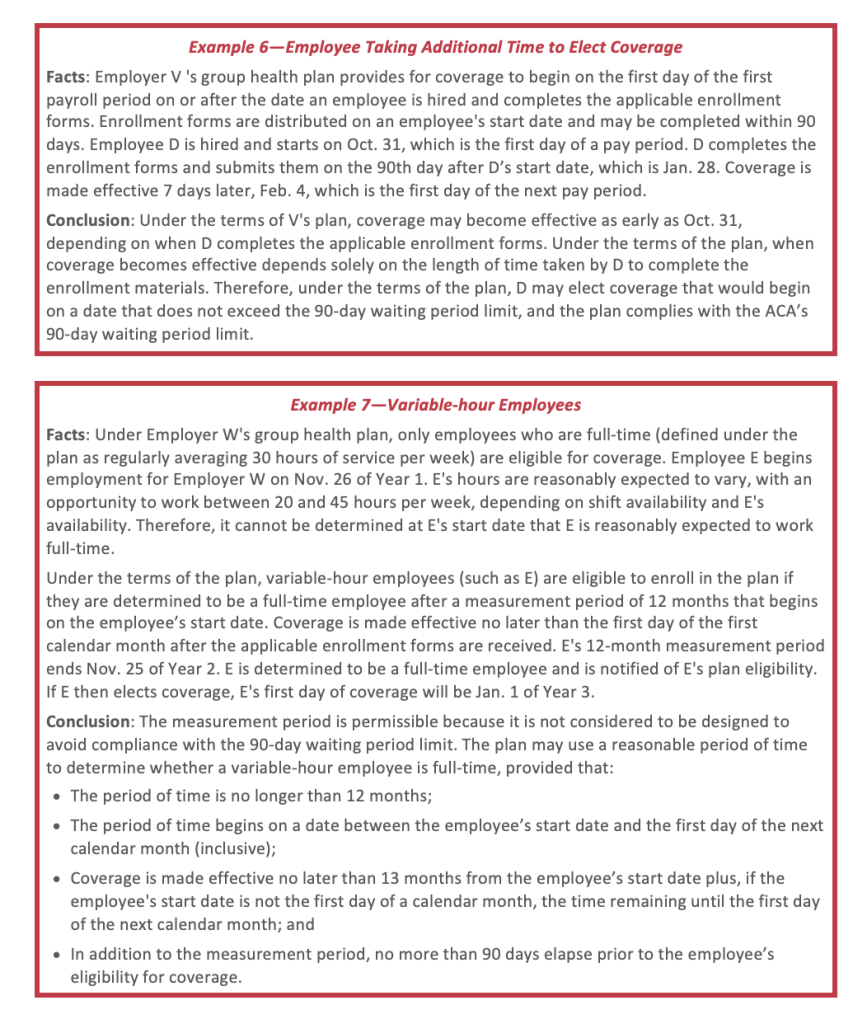

If, under the terms of the plan, an individual can elect coverage that becomes effective on a date that does not exceed 90 days, the coverage complies with the ACA’s 90-day waiting period limit. Thus, a plan or issuer does not violate the ACA merely because employees take additional time to elect coverage.

In addition, if an individual enrolls as a late enrollee or special enrollee, any period before the individual’s late or special enrollment is not a waiting period. The effective date of coverage for special enrollees is set forth in the 2004 HIPAA regulations governing special enrollment (and, if applicable, in HHS regulations addressing guaranteed availability).

Counting Days

When applying the ACA’s 90-day waiting period limit, all calendar days must be counted, beginning on the enrollment date, including weekends and holidays. For a plan with a waiting period, the enrollment date is the first day of the waiting period. A plan or issuer may choose to make coverage effective earlier than the 91st day for administrative convenience, if it:

- Imposes a 90-day waiting period, and the 91st day is a weekend or holiday; or Does not want to start coverage in the middle of a month (or pay period).

- For example, a plan may impose a waiting period of 60 days plus a fraction of a month (or pay period) until the first day of the next month (or pay period), as long as the waiting period does not extend beyond 90 days.

Other Permitted Eligibility Conditions

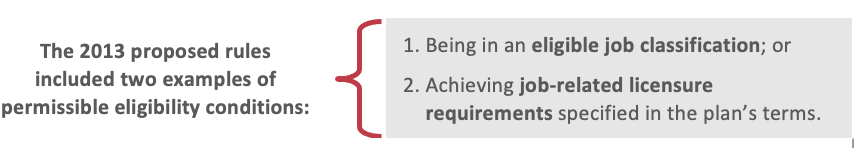

Under the ACA, eligibility conditions that are based solely on the lapse of time are allowed for no more than 90 days. However, other eligibility conditions not based solely on the lapse of time are generally allowed, unless the condition is designed to avoid compliance with the 90-day waiting period limit.

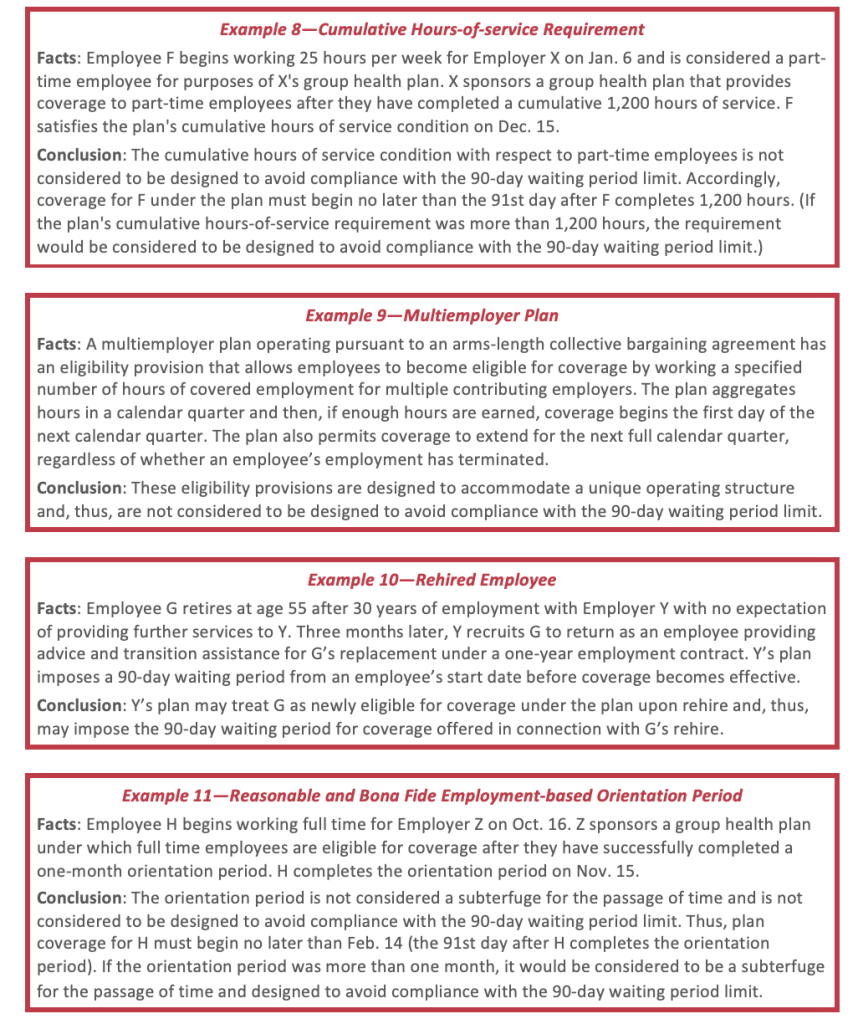

The final rules add a third example of permissible eligibility conditions, allowing the satisfaction of a reasonable and bona fide employment-based orientation period.

Reasonable and Bona Fide Employment-based Orientation Periods

Under the final rules, a requirement to successfully complete a reasonable and bona fide employment-based orientation period may be imposed as a condition for eligibility for coverage under a plan. During an orientation period, an employer and employee could evaluate whether the employment situation was satisfactory for each party, and standard orientation and training processes would begin.

The final rules did not specify the circumstances under which the duration of an orientation period would not be considered “reasonable or bona fide.” However, separate final rules specify one month as the maximum length of any orientation period. The one-month limit is intended to avoid abuse and facilitate compliance with the waiting period restrictions.

According to the Departments, orientation periods are commonplace and they do not intend to call into the question the reasonableness of short, bona fide orientation periods. However, to ensure that an orientation period is not used as a subterfuge for the passage of time or designed to avoid compliance with the 90-day waiting period limitation, an orientation period is permitted only if it does not exceed one month.

For any period longer than one month that precedes a waiting period, the Departments refer back to the general rule providing that the 90-day period begins after an individual is otherwise eligible to enroll under the terms of a group health plan. While a plan may impose substantive eligibility criteria (such as requiring the worker to fit within an eligible job classification or to achieve job-related licensure requirements) it may not impose conditions that are mere subterfuges for the passage of time.

Measuring the One-month Orientation Period

This one-month maximum is generally a period that begins on any day of a calendar month, and would be determined by adding one calendar month and subtracting one calendar day, measured from an employee’s start date in a position that is otherwise eligible for coverage. For example, if an employee’s start date in an otherwise eligible position is May 3, the last permitted day of the orientation period is June 2. Similarly, if an employee’s start date in an otherwise eligible position is Oct. 1, the last permitted day of the orientation period is Oct. 31.

If there is not a corresponding date in the next calendar month upon adding a calendar month, the last permitted day of the orientation period is the last day of the next calendar month. For example, if the employee’s start date is Jan. 30, the last permitted day of the orientation period is Feb. 28 (or Feb. 29, in a leap year). Similarly, if the employee’s start date is Aug. 31, the last permitted day of the orientation period is Sept. 30.

If a group health plan conditions eligibility on completing a reasonable and bona fide employment-based orientation period, the eligibility condition is not considered to be designed to avoid compliance with the 90-day waiting period limit if the orientation period did not exceed one month and the maximum 90-day waiting period would begin on the first day after the orientation period.

Coordination with the ACA’s Employer Shared Responsibility Rules

Employers should note that compliance with the final orientation period rules does not constitute compliance with the ACA’s employer shared responsibility rules (Code Section 4980H). Under the employer shared responsibility rules, an applicable large employer (ALE) may be subject to penalties if it fails to offer affordable, minimum value coverage to certain newly-hired full-time employees by the first day of the fourth full calendar month of employment.

An ALE that has a one-month orientation period may comply with the waiting period limit and avoid Section 4980H penalties by offering coverage no later than the first day of the fourth full calendar month of employment. However, an ALE plan may not be able to impose the full one-month orientation period and the full 90-day waiting period without potentially being subject to a Section 4980H penalty.

For example, if an employee is hired as a full-time employee on Jan. 6, a plan may offer coverage May 1 and comply with both rules. However, if the employer is an ALE and starts coverage May 6 (which is one month plus 90 days after the date of hire) the employer may be subject to a Section 4980H penalty.

Cumulative Hours-of-Service Requirement

If a group health plan or group health insurance issuer conditions eligibility on any employee’s (part-time or full-time) having completed a number of cumulative hours of service, the eligibility condition does not violate the ACA’s 90-day waiting period limit if the cumulative hours-of-service requirement does not exceed 1,200 hours.

The plan’s waiting period must begin on the first day after the employee satisfies the plan’s cumulative hours-of-service requirement, and may not exceed 90 days. Also, this provision is designed to be a one-time eligibility requirement only. A plan or issuer is not permitted to reapply the hours-of-service requirement to the same individual each year.

Application to Variable-Hour Employees

A special rule applies if a group health plan conditions eligibility on an employee regularly working a specified number of hours per pay period (or working full-time), and it cannot be determined that a newly-hired employee is reasonably expected to regularly work that number of hours per period (or work full-time).

In this type of situation, the plan may take a reasonable period of time—up to 12 months and beginning on any date between the employee’s start date and the first day of the first calendar month following the employee’s start date—to determine whether the employee meets the plan’s eligibility condition. This may include a measurement period of up to 12 months that begins on any date between the employee’s start date and the first day of the first calendar month following the employee’s start date. This is consistent with the timeframe permitted for these determinations under the employer shared responsibility rules.

The time period for determining whether a variable-hour employee meets the plan’s hours of service eligibility condition will comply with the ACA’s 90-day waiting period limit if coverage is made effective no later than 13 months from the employee’s start date, except where a waiting period that exceeds 90 days is imposed in addition to the measurement period. If an employee’s start date is not the first of the month, the time period can also include the time remaining until the first day of the next calendar month.

Employees that are Rehired or Change Job Classifications

For purposes of these rules, a former employee who is rehired may be treated as newly eligible for coverage upon rehire. Therefore, a plan or issuer may require that individual to meet the plan’s eligibility criteria and to satisfy the plan’s waiting period anew, if reasonable under the circumstances. The requirement would not be reasonable if the termination and rehire is a subterfuge to avoid compliance with the 90-day waiting period limit. The same analysis would apply to an individual who moves to a job classification that is ineligible for coverage under the plan, but then later moves back to an eligible job classification.

Application to Multiemployer Plans

The Departments recognize that multiemployer plans maintained pursuant to collective bargaining agreements have unique operating structures and may include different eligibility conditions based on the participating employer’s industry or the employee’s occupation. For example, some multiemployer plans determine eligibility based on complex formulas for earnings and residuals or use “hours banks” in which workers’ excess hours from one measurement period are credited against any shortage of hours in a succeeding measurement period, functioning as buy-in provisions to prevent lapses in coverage.

On Sept. 4, 2013, the Departments issued an FAQ on the 90-day waiting period limit as applied to multiemployer plans. This FAQ reiterates that, to the extent plans and issuers impose substantive eligibility requirements not based solely on the lapse of time, these eligibility provisions are permitted if they are not designed to avoid compliance with the 90-day waiting period limit.

Therefore, for example, if a multiemployer plan operating pursuant to an arms-length collective bargaining agreement has an eligibility provision that allows employees to become eligible for coverage by working hours of covered employment across multiple contributing employers (which often aggregates hours by calendar quarter and then permits coverage to extend for the next full calendar quarter, regardless of whether an employee has terminated employment), the Departments would consider that provision designed to accommodate a unique operating structure (and, therefore, not designed to avoid compliance with the 90-day waiting period limitation).

Effective Date

Under the ACA, the 90-day waiting period limit applies for plan years beginning on or after Jan. 1, 2014, for both grandfathered and non-grandfathered group health plans and health insurance issuers offering group health insurance coverage. Group health plans and health insurance issuers were allowed to rely on the 2013 proposed rules through at least the end of 2014. Thus, the Departments considered compliance with the proposed rules to constitute compliance with the 90-day waiting period limit at least through the end of 2014.

The final rules regarding one-month orientation periods apply to group health plans and group health insurance issuers for plan years beginning on or after Jan. 1, 2015. For plan years beginning in 2014, the Departments considered compliance with either the proposed rules or the final rules to constitute compliance with the ACA’s 90-day waiting period limit.

Relation to Employer Shared Responsibility Penalty

Under ACA’s employer shared responsibility—or “pay or play”—rules, ALEs that do not offer affordable, minimum value health coverage to their full-time employees may be subject to a penalty. This penalty took effect for most employers beginning in 2015.

On Feb. 12, 2013, the IRS published final rules that address the ACA’s employer shared responsibility requirements. Under these rules, there are times when an employer will not be subject to a penalty with respect to an employee, even if the ALE does not offer coverage to that employee during that time. However, the fact that an ALE will not owe a penalty under the employer shared responsibility rules for failing to offer coverage during certain periods of time does not, by itself, constitute compliance with the 90-day waiting period limit during that same period.

The employer shared responsibility final rules provide that an ALE will not be subject to a penalty with respect to an employee for not offering coverage to the employee during a period of three full calendar months, beginning with the first day of the first full calendar month of employment (if, for the calendar month, the employee is otherwise eligible for coverage under the ALE’s group health plan). For this rule to apply, the employee must be offered coverage no later than the first day of the fourth full calendar month of employment (if the employee is still employed on that day) and the coverage must provide minimum value. However, if an ALE denies coverage to a full-time employee based on a substantive eligibility condition, such as being in an eligible job classification, the ALE may be subject to a penalty under the ACA. Also, although a cumulative hours-of-service requirement up to 1,200 hours may be permissible under the ACA’s 90-day waiting period limit, denying coverage to full-time employees while they accumulate the necessary number of hours of service may trigger an employer shared responsibility penalty for ALEs.

This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. Design ©2020 Zywave, Inc. All rights reserved. 3/13; BR 4/20