The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows individuals to continue their group health plan coverage in certain situations. Specifically, COBRA requires group health plans to offer continuation coverage to covered employees and dependents when coverage would otherwise be lost due to certain specific events.

These events include the death of a covered employee, termination or a reduction in the hours of a covered employee’s employment, divorce of a covered employee and spouse, and a child’s loss of dependent status under the plan.

COBRA sets rules for how and when continuation coverage must be offered and provided, how employees and their families may elect continuation coverage and when continuation coverage may be terminated. Employers may require individuals to pay for COBRA coverage, although temporary premium assistance under the American Rescue Plan Act was available to eligible individuals for periods of coverage from April 1, 2021, through Sept. 30, 2021. On Sept. 30, 2021, the COBRA premium subsidy ended.

When Does COBRA Apply?

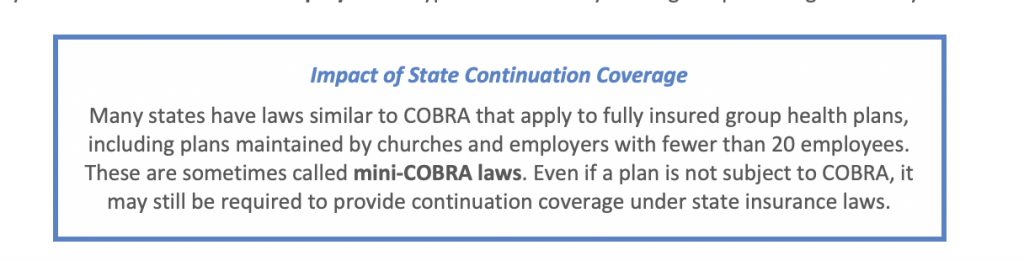

Most private-sector employers that maintain group health plans for their employees must comply with COBRA’s continuation coverage requirements. This includes, for example, corporations, partnerships and tax-exempt organizations. However, COBRA does not apply to group health plans maintained by small employers. A “small employer” means an employer that had fewer than 20 employees on typical business days during the preceding calendar year.

COBRA also applies to plans sponsored by state and local governments. It does not apply, however, to plans sponsored by the federal Government or by churches and certain church-related organizations.

COBRA also applies to plans sponsored by state and local governments. It does not apply, however, to plans sponsored by the federal Government or by churches and certain church-related organizations.

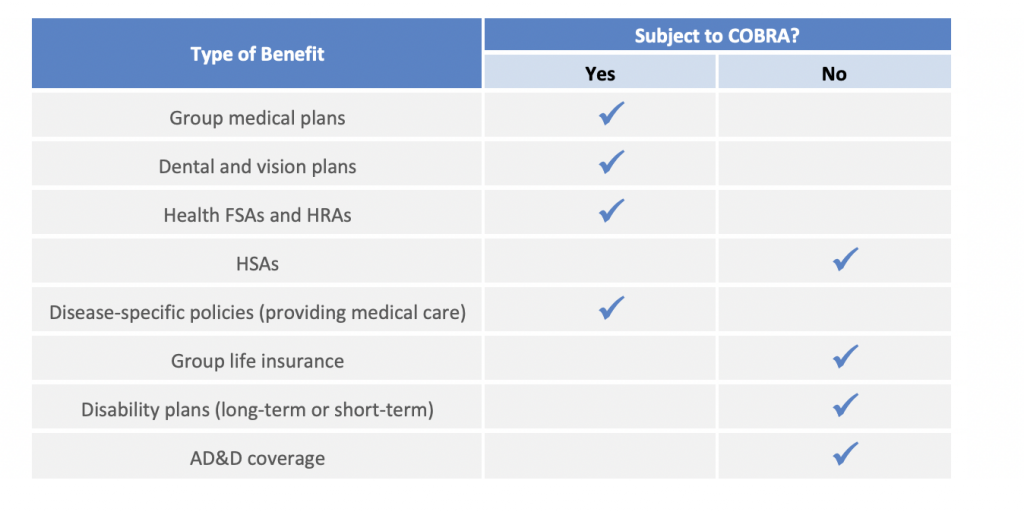

Once an employer determines that it is subject to COBRA, it must look at its plans. An employer-sponsored welfare benefit plan is subject to COBRA if it provides medical care. “Medical care” broadly includes medical, dental, vision and drug coverage. The following table indicates whether welfare benefits commonly offered by employers are subject to COBRA:

Who is Entitled to COBRA Coverage?

A group health plan is required to offer COBRA continuation coverage only to qualified beneficiaries and only after a qualifying event has occurred.

Qualified Beneficiaries

A qualified beneficiary is an individual who was covered by a group health plan on the day before a qualifying event occurred and who is an employee, an employee’s spouse or former spouse, or an employee’s dependent child. In addition, any child born to or placed for adoption with a covered employee during a period of continuation coverage is automatically considered a qualified beneficiary.

Qualifying Events

An employer must offer COBRA coverage only when group health plan coverage ends (or would end) due to a qualifying event. Not all losses of health coverage are caused by qualifying events. For example, a cancellation of health plan coverage—whether at the employee’s request or because of the employee’s failure to pay premiums—is not, by itself, a qualifying event that triggers the requirement to offer COBRA coverage.

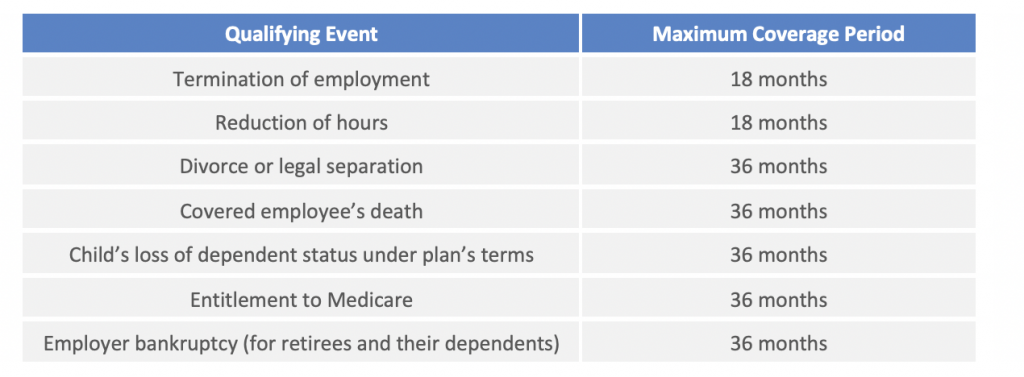

The period of COBRA coverage offered to qualifying beneficiaries is known as the “maximum coverage period.” The length of the maximum coverage period depends on the type of qualifying event that has occurred. There are situations where the maximum coverage period can be extended (due to disability or a second qualifying event) or terminated early (for example, when COBRA premiums are not paid).

The following chart outlines the seven qualifying events under COBRA and the corresponding maximum coverage periods:

How Long Does COBRA Coverage Last?

COBRA requires that continuation coverage extends from the date of the qualifying event for a limited period of time of 18 or 36 months, as described in the chart above. A group health plan may terminate continuation coverage earlier than the end of the maximum period for any of the following reasons:

- Premiums are not paid in full on a timely basis;

- The employer ceases to maintain any group health plan;

- A qualified beneficiary begins coverage under another group health plan after electing continuation coverage;

- A qualified beneficiary becomes entitled to Medicare benefits after electing continuation coverage; or

- A qualified beneficiary engages in conduct that would justify the plan in terminating coverage of a similarly situated participant or beneficiary not receiving continuation coverage (such as fraud).

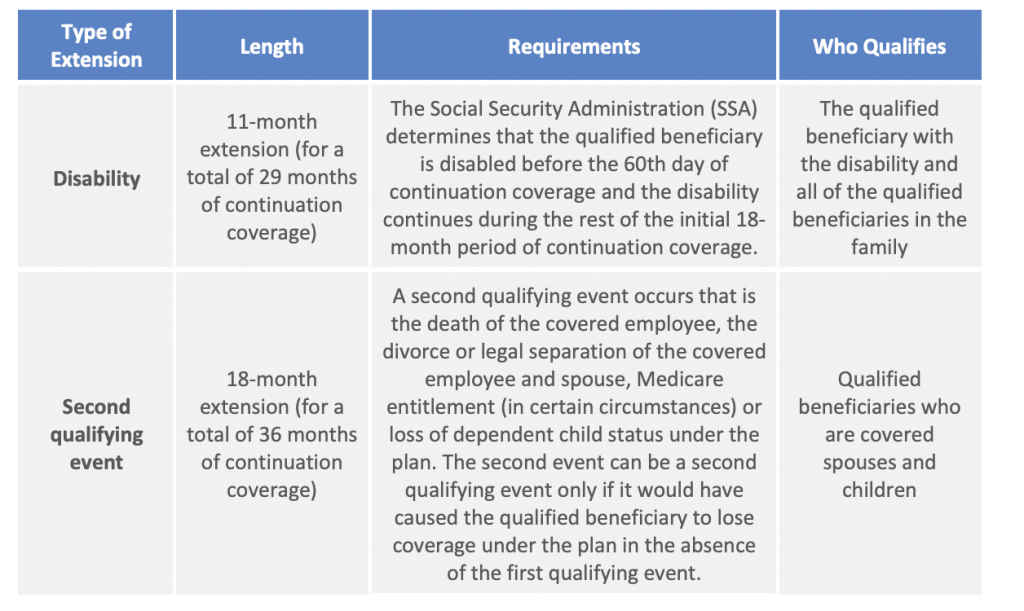

If continuation coverage is terminated early, the plan must provide the qualified beneficiary with an early termination notice. There are two situations that can extend the 18-month maximum period of continuation coverage:

What Benefits Must Be Offered?

Qualified beneficiaries must be offered coverage that is identical to that available to similarly situated beneficiaries who are not receiving COBRA coverage under the plan. Generally, this will be the same coverage that the qualified beneficiary had immediately before qualifying for continuation coverage. A change in the benefits under the plan for the active employees will also apply to qualified beneficiaries. Qualified beneficiaries must be allowed to make the same choices given to non-COBRA beneficiaries under the plan, such as during periods of open enrollment by the plan.

Who Pays for COBRA Coverage?

Group health plans can require qualified beneficiaries to pay for COBRA continuation coverage, although plan sponsors can choose to provide continuation coverage at reduced or no cost. The maximum amount charged to qualified beneficiaries cannot exceed 102 percent of the cost to the plan for similarly situated individuals covered under the plan who have not incurred a qualifying event. For qualified beneficiaries receiving the 11-month disability extension, the premium for those additional months may be increased to 150 percent of the plan’s total cost of coverage.

COBRA premiums may be increased if the costs to the plan increase, but they generally must be fixed in advance of each 12-month premium cycle. The plan must allow qualified beneficiaries to pay premiums on a monthly basis if they ask to do so, and the plan may allow them to make payments at other intervals (weekly or quarterly).

Also, qualified beneficiaries cannot be required to pay premiums at the time they make COBRA elections. Plans must provide at least 45 days after the election for making an initial premium payment. If a qualified beneficiary fails to make any payment before the end of the initial 45-day period, the plan can terminate the qualified beneficiary’s COBRA rights. The plan sponsor may establish due dates for premiums for subsequent periods of coverage, but it must provide a minimum 30-day grace period for each payment.

|

COVID-19-Related Deadline Relief Due to the COVID-19 pandemic, the federal government has extended the time to furnish COBRA notices and disclosures, if good faith efforts are made to provide them as soon as administratively practicable. Participants also have additional time to comply with deadlines to elect and pay for regular COBRA coverage, as well as notify the plan of a qualifying event. IRS Notice 2021-58 clarifies the application of the COBRA deadline extensions for electing COBRA coverage and paying COBRA premiums. |

What Notices Must Be Provided?

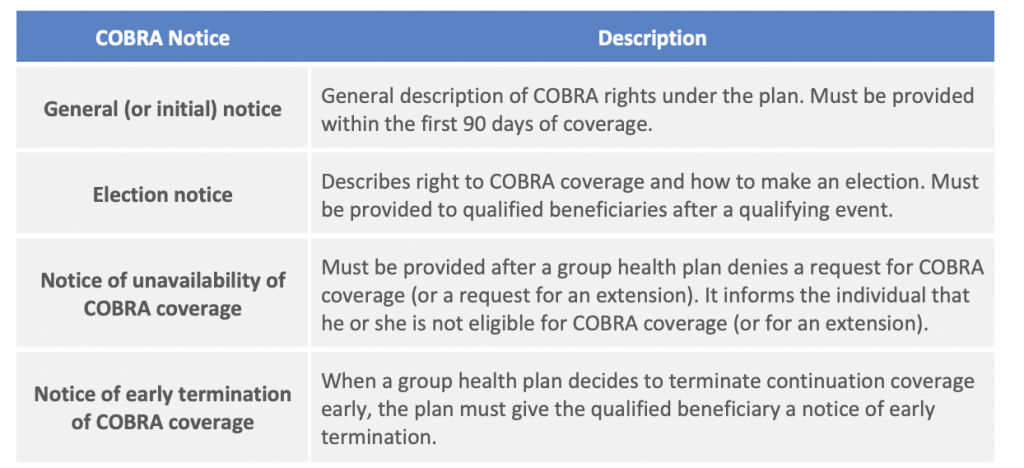

The following COBRA notices are required to be provided in certain situations:

General Notice

Group health plans must give plan participants a general notice describing COBRA rights under the plan. The general notice must be provided within the first 90 days of coverage. Group health plans can satisfy this requirement by including the general notice in the plan’s summary plan description (SPD) and by delivering the SPD within this time limit.

Election Notice

After receiving a notice of a qualifying event, the plan must provide the qualified beneficiaries with an election notice, which describes their rights to continuation coverage and how to make an election. The election notice must be provided to the qualified beneficiaries within 14 days after the plan administrator receives the notice of a qualifying event from the employer or a qualified beneficiary.

The employer is required to notify the plan administrator of most qualifying events. However, qualified beneficiaries are responsible for notifying the plan administrator of a divorce (or legal separation) or a dependent child’s loss of dependent status under the plan.

In many cases, the employer is also the plan administrator. For qualifying events where the employer is required to provide notice to the plan administrator (termination or reduction in hours, death of the employee, or employee becoming entitled to Medicare) and the employer is also the plan administrator, the election notice must be provided to the qualified beneficiary within 44 days of the later of:

- The date of the qualifying event; or

- The date on which the qualifying beneficiary loses coverage due to the qualifying event.

Notice of Unavailability of COBRA Coverage

Group health plans may sometimes deny a request for continuation coverage (or for an extension of continuation coverage) when the plan determines the requester is not entitled to receive it. When a group health plan makes the decision to deny a request for continuation coverage (or a request for an extension), the plan must give the individual a notice of unavailability of continuation coverage. The notice must be provided within 14 days after the request is received, and the notice must explain the reason for denying the request.

Notice of Early Termination of COBRA Coverage

Continuation coverage must generally be made available for a maximum period (for example, 18 or 36 months). The group health plan may terminate continuation coverage early, however, for any of a number of specific reasons. When a group health plan decides to terminate continuation coverage early for any of these reasons, the plan must give the qualified beneficiary a notice of early termination. The notice must be given as soon as practicable after the decision is made, and it must describe the date that coverage will terminate, the reason for termination, and any rights the qualified beneficiary may have under the plan or applicable law to elect alternative group or individual coverage.

What are the Rules for Electing COBRA?

COBRA requires group health plans to give qualified beneficiaries an election period during which they can decide whether to elect continuation coverage. COBRA also gives qualified beneficiaries specific election rights.

General Rules: At a minimum, each qualified beneficiary must be given at least 60 days to choose whether to elect COBRA coverage. This 60-day period is measured from the later of: (1) the date the election notice is provided; or (2) the date on which the qualified beneficiary would otherwise lose coverage under the group health plan due to the qualifying event. However, as stated on page 5, COVID-19 deadline relief extends the timeframes for health plan participants to elect COBRA coverage.

Each qualified beneficiary must be given an independent right to elect continuation coverage. This means that when several individuals (such as an employee, his or her spouse and their dependent children) become qualified beneficiaries due to the same qualifying event, each individual can make a different choice. The plan must allow the covered employee or the covered employee’s spouse, however, to elect continuation coverage on behalf of all of the other qualified beneficiaries for the same qualifying event. A parent or legal guardian of a qualified beneficiary must also be allowed to elect on behalf of a minor child.

If a qualified beneficiary waives continuation coverage during the election period, he or she must be permitted to later revoke the waiver of coverage and elect continuation coverage, as long as the revocation is done before the end of the election period. If a waiver is later revoked, however, the plan is permitted to make continuation coverage begin on the date the waiver was revoked.